Major leadership changes expected in the financial sector in 2024

According to a report in the Business Standards, the Indian financial sector is poised for significant leadership changes in 2024. Nearly a dozen banks and non-banking finance companies (NBFCs) are expecting new Chief Executive Officers (CEOs). The Reserve Bank of India (RBI) is also set to witness a transformation in its Monetary Policy Committee (MPC).

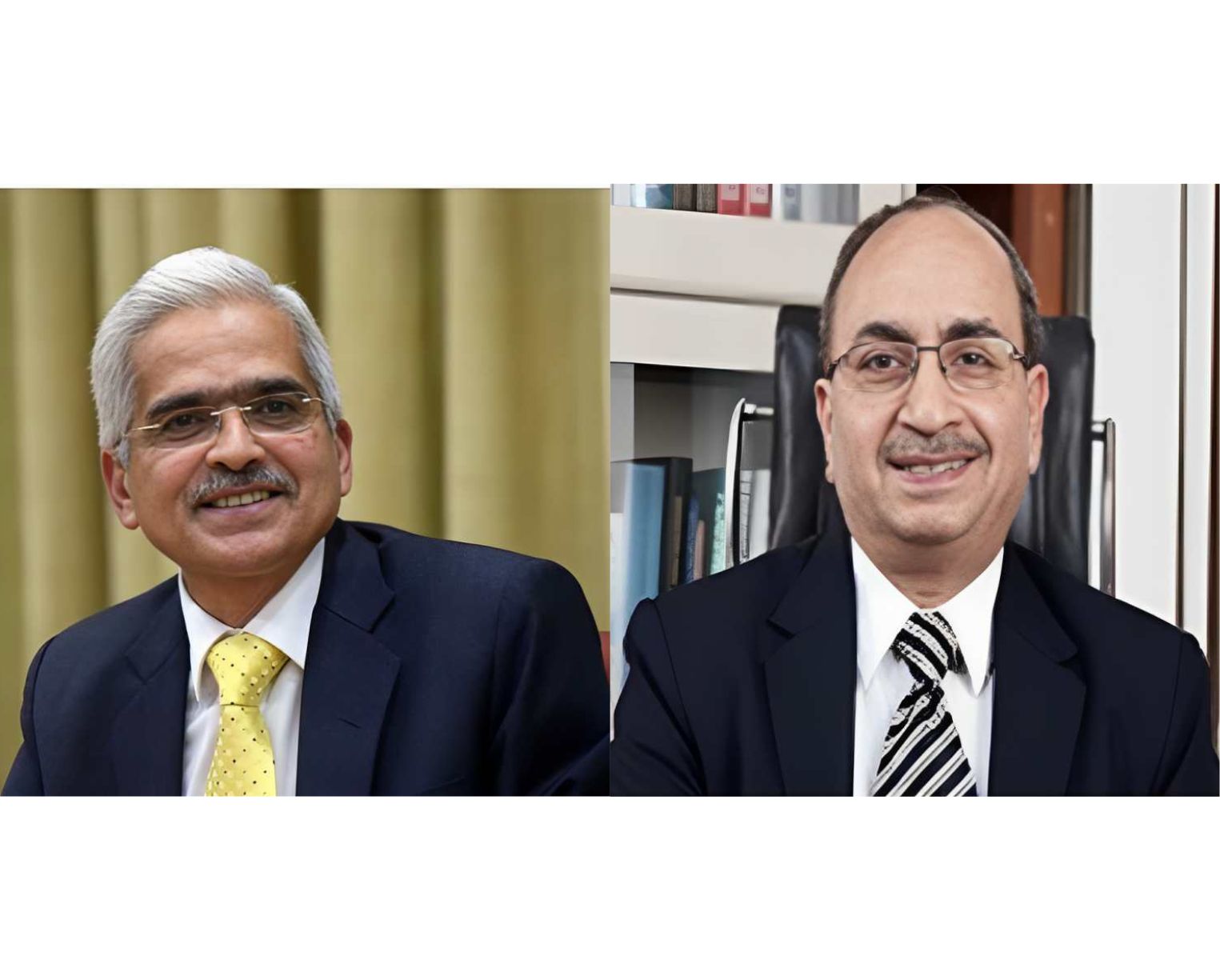

Shaktikanta Das, the current RBI Governor and MPC Chair, will conclude his six-year term in December 2024. Originally appointed in December 2018 for a three-year term and subsequently reappointed in 2021, Das is on track to become the longest-serving RBI governor in nearly seven decades. The decision to extend his term further will be made by the new government formed in May.

The term of Michael Patra, the RBI deputy governor overseeing monetary policy, is scheduled to end in January 2024. His term was extended by a year in January 2023. Another deputy governor, M. Rajeshwar Rao, will see his term conclude in October next year, having been granted a one-year extension in October.

The Monetary Policy Committee will witness changes in its external members, including Ashima Goyal, Jayanth Varma, and Shashanka Bhide, who were appointed for four-year terms, in October 2020. The terms of the external MPC members can’t be extended.

Several public sector banks (PSBs) are also set for leadership transitions in 2024. Dinesh Khara, Chairman of the State Bank of India, will complete his term in August next year. Additionally the CEOs of Punjab National Bank (Atul Kumar Goel) and Indian Bank (S.L. Jain) will see their terms conclude at the end of December 2024.