Institutional Investors Question Higher Executive Compensation Based on ESG Metrics

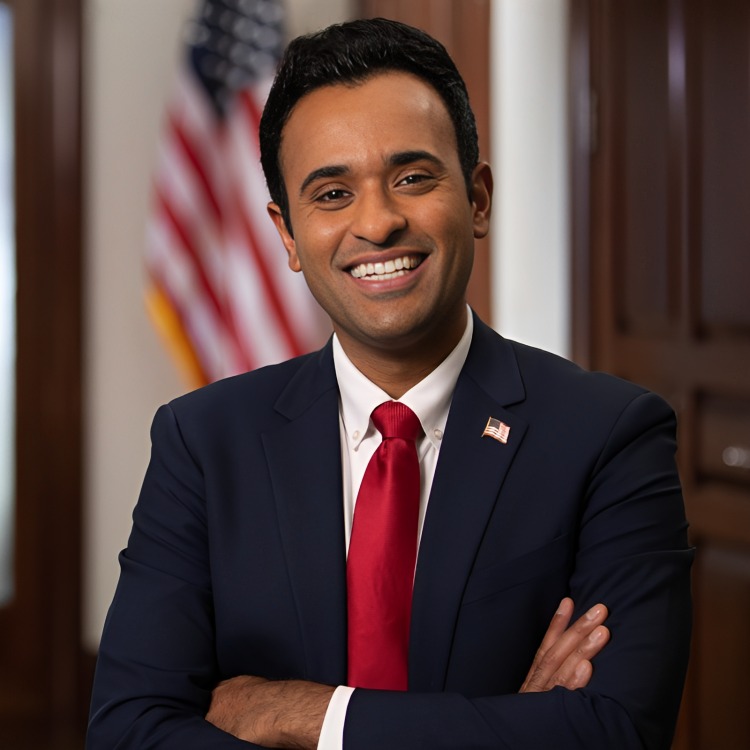

Vivek Ramaswamy has been in the news over the last few weeks, emerging as one of the most talked about Republican candidates for the 2024 US presidential primary. In the meantime, an asset management company, Strive Asset Management co-founded by Ramaswamy is questioning ESG Metrics used by Southwest Airlines to determine compensations for its management team.

According to a report in the Financial Times, the Airline informed shareholders that the company performed above target level expectations with respect to ESG (Environmental, Social, Governance) initiatives including DEI (Diversity, Equity, Inclusion). Strives Asset Management believes that there is only one way an airline can cut its carbon footprint, and that is by grounding “thousands of flights.”

A number of Republican representatives have been critical of ESG practices. Experts point out that rather than the hard environmental protection and energy efficiency parameters companies are assigning higher weightage to softer metrics like Diversity, Inclusion, customer experience, and Community Engagement.

Activist investors and Republican ideologues believe that executive compensation should be driven by corporate profitability more than anything else. Data suggests that the inclusion of ESG and DEI parameters has been on the rise over the last decade. Nearly half of S&P 500 companies and around three-fourth of the firms included in the Russell 3000 index assess their executives on ESG parameters and up to 20% compensation is based on these scores.